Banking System in Canada

Banking in Canada is widely considered the safest and most efficient in the world. Each of the largest banks in Canada has a dedicated division that can assist newcomers with their financial transition. Banks can also provide informational publications to newcomers in many languages, including English, French, Chinese, Punjabi, Hindu, Urdu, Tamil, Tagalog, Farsi, Korean, Romanian, Spanish and Russian.

Canada’s federal government has sole jurisdiction for banks. Provincial governments regulate credit unions, caisses populaires, securities dealers, and mutual funds.

The Government of Canada provides insurance for deposits up to $100,000 per bank account in Canada, ensuring the safety of your money in the unlikely event that a Canadian bank goes bankrupt.

Banks available in Canada

There are 70 banks operating in Canada. There are over 8,000 bank branches across the country.

Canada has five major banks, also know as “The Big Five”:

- the Canadian Imperial Bank of Commerce (CIBC),

- the Bank of Montreal (BMO),

- Toronto Dominion Bank (TD Canada Trust),

- the Royal Bank of Canada (RBC),

- Bank of Nova Scotia (Scotiabank).

These “Big Five” are international financial conglomerates, and are among some of the best and most secure banks in the world. Besides retail banking, these banks also offer mutual funds, insurance, real estate, credit cards, and brokerage services. The Big Five also have offices, own banks, and operate internationally.

Notable second tier banks in Canada include HSBC Bank Canada, ING Bank of Canada, the National Bank of Canada, the Laurentian Bank, the Desjardins Group, Manulife Bank of Canada, and President’s Choice Bank.

International banks in Canada include AMEX, Bank of China, Bank of Tokyo-Mitsubishi, BNP Parbibas, Capital One, Citibank, Deustche Bank, Habib, Royal Bank of Scotland, Shinhan Bank, State Bank of India, Sumitoro Mitsui Banking Corporation, and UBS.

The Bank of Canada is Canada’s Central Bank and is owned by the Government of Canada.

How to Open a Bank Account

In Canada it is vital to have a bank account. 96% of Canadians have a savings, chequing, or other account with a financial institution.

Day to day purchases are commonly made with debit/Interac and credit cards. The use of cash is rare, and the use of cheques is rarer.

Account types

The basic banking account types in Canada are savings and chequing or banking accounts. Savings accounts allow you to accrue interest on savings, which are always accessible. Traditionally, chequing or banking accounts are used to day-to-day purchases.

US accounts are also available and are useful if you make US dollar transactions or travel to the US or other countries where US dollars are used.

Banks in Canada offer more than 100 different savings and chequing/banking accounts with varying levels of service and fees. Some accounts have a limited number of transactions for a fee, some offer overdraft protection, allow you to make numerous affordable transfers, etc. Most banks also offer low or no-fee accounts for youths, seniors, students, and individuals who maintain a minimum monthly balance (about 31% of Canadians).

Basic accounts are available at major banks for $4 a month or less. 60% of Canadians spend $15 or less per month on service fees. To chose the right account for your needs, assess what account features you use, how often you use them, and what service fees are charged for those features.

Opening an Account

You can apply for a Canadian bank account online, even from overseas, or at most bank branches in Canada.

To open a bank account as an expat you must present two types of identification. At least one piece of identification must be one of the following: Permanent Resident card (IMM 5292 – Confirmation of Permanent Residence) or Citizenship and Immigration Canada Form IMM 1000 or IMM 1442 (Student Authorization; Employment Authorization; Visitor Record; Temporary Resident’s Permit), or a driver’s license issued in Canada, or a provincial photo ID card issued in Canada, or a provincial health insurance card issued in Canada. If you cannot produce two of these pieces of identification, you may present one of the aforementioned identity documents, and your foreign passport.

If the identification presented to open an account does not contain your name, date of birth, address and occupation the bank may request that you provide this information, except if you do not have an address or are unemployed.

If your application to open a bank account is refused (likely on grounds of suspicion of illegal or fraudulent activities, identity falsification, etc.) you will be advised in writing.

If you have been bankrupt, you will generally be permitted to open an account as long as there is no evidence of fraud or any other illegal activity in relation to your bankruptcy.

Income tax reporting requirements

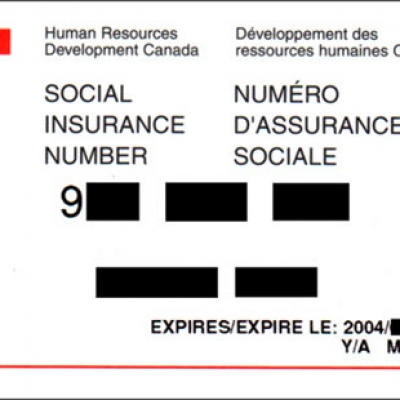

Banks will ask for your Social Insurance Number (SIN) when you open an interest-accruing account, so the bank can report your interest income to the government. Any account, however, can be opened without a SIN.

Bank cards

Credit Unions

Canada has the world’s highest per capita membership in the credit union movement, with over 10 million members, or about one third of the Canadian population.

Canada’s co-operative financial services sector consists mainly of credit unions, most popular in Western Canada, and caisses populaires, popular mainly in Quebec.

Debit Cards

You can get a debit card by opening an account at a Canadian bank.

Debit cards are the most frequently used form of day-to-day banking in Canada. 94% of Canadians have a debit card to use at retailers and ATMs.

Using your debit card, you can make purchases at over 450,000 retailers across the country, withdraw cash, email money transfers, pay bills, and shop online.

Regardless of transaction or debit card type, debit card users are always protected against fraudulent activity, and receive reimbursement if they are a victim of fraud.

Most Canadian debit cards can be used at any ATM (bank-owned or private) that displays the INTERAC symbol in Canada, and the PLUS symbol internationally.

Credit Cards

The major credit card companies in Canada are Visa and Mastercard, followed by AMEX and Discovery. Credit cards in Canada provide interest-free credit from the time of purchase to the end of the billing period. For those who carry a balance, there are more than 70 low interest rate credit cards available in Canada, and 40 that carry an interest rate of less than 12%.

Credit card incentive programs, such as Air Miles and Aeroplan, are very popular in Canada. Some credit card programs also provide travel insurance to their clients.

Credit card users in Canada enjoy excellent fraud protection, with zero liability to the consumer in cases of fraud.

Most banks in Canada will not give you a credit card if you do not have any Canadian credit history (with the exception of students). Even if you have a long history with worldwide credit companies outside of Canada, such as Visa or Mastercard, you still may not be able to get a credit card in Canada immediately.

How to get a credit card

If you are an expat applying for a credit card in Canada for the first time, with no established credit history in Canada, talk to your bank manager and ask if the bank will recognize your foreign credit history and give you a regular (unsecured) card. Be sure to present copies of any credit information you have outside of Canada. It may also be useful to present a letter from your employer that outlines your annual salary

If your application is refused you must build credit in Canada before obtaining a credit card.

To build credit in Canada, you can get a secured credit card. For this type of card you must make a security deposit (usually $500-$1000) with the credit card company. You can also apply for a joint card with a friend or family member who has credit history in Canada, get a co-signer who is responsible for any unpaid bills on your credit card account, take out a loan and pay it off quickly, or join a credit union in your community.

You can also get a retail credit card from a non-financial institution (e.g. a supermarket, gas station, or department store). You can use retail credit cards to purchase things at some retailers, but you cannot use them to borrow money. Such credit cards often have very high interest rates (25%+).

ATMs/ABMs

There are over 18,000 bank-owned Automated Teller Machines (ATM’s) across Canada. At your bank’s ATMs you can withdraw cash, transfer funds, deposit cash and cheques, check your account balances, or change your debit card PIN.

If you use services at a bank’s ATM that is not your bank, you may be charged fees.

Cheques

Cheques are not accepted at most major retailers in Canada, and are typically used to transfer payments between individuals or small businesses, to pay for rent, utilities, etc.

When depositing a cheque, you may be required to authenticate the cheque by signing it on the reverse side.

Sometimes when you deposit a cheque into your bank account in Canada you may be told that a ‘hold’ has been placed on it. This means that while the funds appear in your account, you cannot withdraw or access that money until after the cheque has been verified and cleared. Hold periods range from 5 to 25 days. Some bank accounts only place holds on cheques deposited at ATMs, but waive holds if cheques are deposited at a bank office in person.

Remote banking

Online Banking

Most banks in Canada offer some form of online banking. Almost any service you can access at a bank branch in person, you can also access online, 24 hours a day.

To set up online banking services, contact your bank. Online banking web sites are generally listed on the reverse side of your credit or debit card. When logging into most online banking services you will be required to input your debit card number and a password. You may also be required to answer enhanced security questions (e.g. Your mother’s maiden name, you favourite book, etc.).

Telephone Banking

Almost all banks offer some form of telephone banking services, toll free and accessible from anywhere in the world.

To access telephone banking services, contact your bank. Telephone banking contact numbers are generally listed on the reverse side of your credit or debit card. When calling, you will be required to input your debit card number and a PIN number.

Mobile Banking

Many banks in Canada are moving towards offering mobile banking solutions, notably Canada’s Big Five banks. These mobile banking apps allow you to access most services you could access in person at a branch, online, or via telephone, from the palm of your hand. As with online banking, you will be required to input your debit card number and a password to access these services.

Information about mobile banking is generally available from your bank’s web site.

By Jess Gerrow, who traded city life in Canada for island life in the Mediterranean two years ago. She is a postgraduate marketing student, blogger, and freelance writer.

- My Life Abroad -

A selection of expat stories

"A fun compulsive read!"

J. Matcham, Amazon

"I strongly advise people ready to live abroad to read this book!"

Patrice, Amazon

Social Insurance Numbers

Social Insurance Numbers Fexco payment solutions

Fexco payment solutions