How to file an Individual FBAR

How to file an FBAR

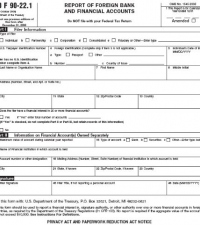

FBAR refers to Form 114, Report of Foreign Bank and Financial Accounts, that must be filed with the Financial Crimes Enforcement Network (FinCEN), which is a bureau of the Treasury Department. The form must be filed electronically either through the BSA E-FilingSystem website or by a US accountant.

What accounts need to be reported?

All US citizens including expats living abroad are required to file an FBAR which needs to be filed for foreign financial accounts held outside the US which were in aggregate at any time in the year that amount to $10,000. A joint FBAR can be filed for a taxpayer and spouse who are both US citizens, however if the spouse has a separate account in his or her name with an aggregate amount exceeding $10,000 he or she too will need to file a separate FBAR in addition to filing a Joint FBAR for joint accounts.

An FBAR also needs to address joint accounts even if the joint account holder is not a US citizen. Hence if a US citizen is married to a non resident alien he will have to report the joint account on his FBAR. Joint accounts also need to be reported even if the other account holder is a non related member to the taxpayer or even if it is a child or other family member.

Signature Authority accounts also need to be reported on an FBAR. If an expat is for example a CEO or Director of a Company outside the US and has signature authority over the bank account of the company, that account will need to be reported on the FBAR, as well.

What if I have not been filing in the past years?

The IRS has also stated that for those who need to file FBARs (Foreign Bank Account Reports), who have never filed, filing 6 years is sufficient and that that late filers who were not aware of the requirement will not be penalized for making quiet disclosures in this manner. This is a welcome development in what had been a very grey area for US expat tax filers, many of whom wished to be compliant, but had no clear guidance from the IRS itself.

The FBAR filing requirement is not part of filing a tax return. The FBAR Form 114 is filed separately and directly with FinCEN. FBAR filings have surged in recent years, according to data from FinCEN. FBAR filings exceeded 1 million for the first time in calendar year 2014 and rose nine of the last 10 years from about 280,000 back in 2005.

The FBAR is due by June 30 following the tax year. There is no additional extension for taxpayers living outside the US. Missing a filing deadline is not something to take lightly, especially when the IRS, the Financial Crimes unit of the Treasury Department and the Justice Department are all over FBARs these days. June 30, 2016 is the filing deadline for 2015 FBARs.

Will filing one FBAR prompt questions about whether you had the account in the past? Why didn’t you file then? Since the statute of limitations for civil or criminal violations is generally six years, opening yourself up to that kind of exposure is frightening.

For some taxpayers, there is no perfect answer. You don’t want to ignore a filing obligation now that you know about FBARs. But one should consider where you are going long term with your issues, how quickly you plan to act, and whether you have good and accurate information to file now.

If you have any questions about which accounts needs to be included in the FBAR, how to file the FBAR, or what to do if you have not been filing, the best course of action is to contact a tax professional.

By Joshua Katz, CPA, the founder of Universal Tax Professionals, a tax and accounting firm dedicated to the needs to Americans living abroad. Feel free to email Joshua with any questions at josh@universaltaxprofessionals.com.

- My Life Abroad -

A selection of expat stories

"A fun compulsive read!"

J. Matcham, Amazon

"I strongly advise people ready to live abroad to read this book!"

Patrice, Amazon

Pension Plans in the USA

Pension Plans in the USA How exchange rates can affect how you pay for a property overseas

How exchange rates can affect how you pay for a property overseas What are the Benefits of using a Broker to Manage Regular Overseas Payments?

What are the Benefits of using a Broker to Manage Regular Overseas Payments? Fexco payment solutions

Fexco payment solutions Covering medical expenses in the US with insurance

Covering medical expenses in the US with insurance Cost of Studying in the USA for International Students

Cost of Studying in the USA for International Students