Retirement system

Canada’s retirement system is based on three pillars:

- The Canadian Pension Plan (CPP),

- Old Age Security (OAS), and

- private employer-sponsored pensions or tax-deferred individual savings (Registered Retirement Savings Plans or RRSPs).

The standard age for retirement in Canada is 65, however, Canadian labour laws do not specify a retirement age and one cannot be forced to retire according to age.

CPP is available to those aged 60 and older, and OAS is available to those aged 65 and older. Sixty-five is also the age at which most private retirement plans have been designed to provide income.

In 2012 it was announced that in 2023 the retirement age at which individuals would be eligible for Old Age Security would rise to 67.

Visas & Immigration

Canada does not have a retiree immigration category, and no special visas or programs are offered to retirees. Most retirees can apply for immigration status under the ‘Investor/Entrepreneur/Self-Employed’ or ‘Family’ immigration categories, where applicable.

Retired persons moving to Canada must prove they have sufficient funds to support themselves, e.g. pension or bank statements.

Old Age Security

The Old Age Security pension is a taxable monthly social security payment. As of January 2012, the basic OAS amount is $540 per month.

Full OAS pension is available to individuals who have lived in Canada for at least 40 years after turning 18. Full OAS pension is also available to those born in or before 1952 and who lived in Canada for some period of time after they turned 18 until 1977, and who lived in Canada for 10 years before the application was approved.

Partial OAS pensions are available to any Permanent resident of Canada aged 65 or older who has lived in Canada for the last 10 years.

Canadian Pension Plan

CPP is a contributory, earnings-related social insurance program. If you are older than 18 and are working in Canada, CPP contributions are automatically deducted from your income and placed in this nationally administered pension plan. The prescribed contribution rate is approximately 5%.

When you turn 60 you are eligible to receive a reduced CPP pension. When you turn 65 you will begin receiving full CPP pension benefits, calculated as 25% of the average contributory maximum over your entire working life. CPP benefit payments are taxable as normal income.

The CPP also provides disability pensions to eligible workers and survivor benefits to survivors of workers who die before they begin receiving retirement benefits.

In Quebec, the Quebec Pension Plan (QPP) takes the place of the CPP.

Private pensions

Various private pension plans are available through employers in Canada. Some plans are contributed to by both employee and employer, and contributions can be matched dollar for dollar or based on terms of employment and income. These plans are generally not dependent on residency or citizenship.

Registered Retirement Savings Plans

Many workers in Canada chose to put their retirement savings in Registered Retirement Savings Plans (RRSP’s). This allows full control over how much to save and where your savings are invested. RRSP contributions are tax deductible, and interest earned prior to the time you begin withdrawing funds is tax free. When your RRSP begins to pay out you will pay tax on this income.

Home country pensions

Eligibility for receiving a pension from your home country while residing in Canada varies from country to country. If you are eligible to receive your home country’s pension in Canada, any pension income brought into Canada is subject to income tax.

Canada has double taxation agreements with many countries, such as the US, therefore you should not have to pay tax on your pension income in your home country as well.

The Government of Canada’s Service Canada Department provides comprehensive information about eligibility for home country pensions while residing in Canada.

By Jess Gerrow, who traded city life in Canada for island life in the Mediterranean two years ago. She is a postgraduate marketing student, blogger, and freelance writer.

- My Life Abroad -

A selection of expat stories

"A fun compulsive read!"

J. Matcham, Amazon

"I strongly advise people ready to live abroad to read this book!"

Patrice, Amazon

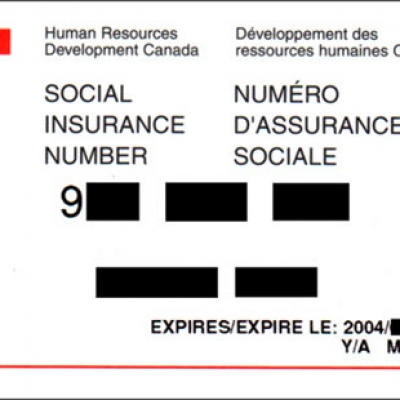

Social Insurance Numbers

Social Insurance Numbers Fexco payment solutions

Fexco payment solutions