Tax system and rates

The Canada Revenue Agency (CRA) is responsible for the collection and administration of taxes in Canada.

Canada’s tax system is similar to that of many countries. Canada’s tax system pays for roads, public utilities, schools, health care, economic development, cultural activities, defence, and law enforcement.

In Canada employers usually deduct taxes from the income they pay you.

Every year, you determine how much tax you must pay by completing an income tax return and sending it to the CRA.

Most individuals who reside in Canada file only one income tax return for the tax year (January 1st-December 31st) because the CRA collects taxes on behalf of all provinces and territories in Canada, except Quebec. The CRA also collects corporate taxes for all provinces/territories, except Quebec and Alberta.

On an income tax return you must list your income and deductions, calculate federal and provincial/territorial tax, and determine if you have a balance owing for the year, or whether you are entitled to a refund for some or all of the tax that was deducted from your income by your employer during the year.

Income tax returns in Canada must be filed on or before April 30th of the year after the tax year. E.g. April 30th 2012 for the 2011 tax year. Small business owners submit income tax returns in June.

Balances of taxes owing must be paid on or before April 30th of the year after the tax year, regardless of the due date of your tax return.

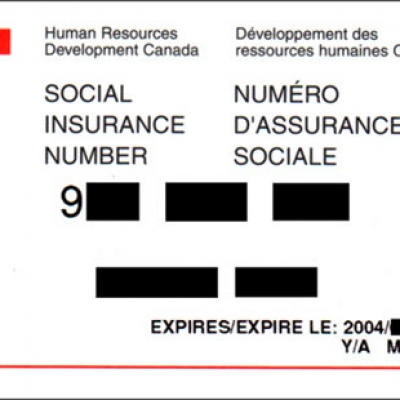

Your Social Insurance Number (SIN) identifies you for tax purposes in Canada. You should apply for a SIN as soon as you arrive in Canada.

In Canada you should keep all supporting documents and income tax records for six years. Receipts and supporting documentation should be ready to support your claims in case you are selected for tax review or audit.

Tax Rates

As of 2012, federal tax rates for individuals in Canada are:

- 15% on the first $42,707 of taxable income +

- 22% on the next $42,707 of taxable income +

- 26% on the next $46,992 of taxable income +

- 29% of taxable income up to $132,406 CAD

Provincial tax rates for individuals vary from 4%-10% on the first $40,000 +/- of taxable income, to 10%-20% of taxable income up to $150,000 CAD. Generally, the more income you make, the higher your tax rate.

In the province of Alberta, a flat 10% tax rate applies to all taxable income of individuals.

Federal corporate taxes in Canada are 15% as of 2012.

Generally, provinces/territories have two rates of income tax for corporations: a lower rate for small businesses, and a higher rate for all other income. Lower rates are approximately 4%, while higher rates range from 10%-16%.

The latest individual and corporate federal and provincial tax rates can be found on the CRA’s web site.

Tax slips

Your Canadian employer, payer, administrator, and/or school will send you various tax slips by the end of February or March.

Some of these tax slips include:

- T4 – Statement of Remuneration Paid (from your employer)

- T4A – Statement of Pension, Retirement, Annuity, and Other Income

- T4A(OAS) – Old Age Security (from the government)

- T4A(P) – Canadian Pension Plan (from the government)

- T4E – Statement of Employment Insurance and Other Benefits (from the government)

- T4RSP – Statement of Registered Retirement Savings Plan income

- T2202A – Education Tax Receipts (from your university or college)

You can obtain your Old Age Security (OAS), Employment Insurance (EI), and Canadian Pension Plan (CPP) tax slips electronically from Service Canada.

You can view sample tax slips here.

You must collect and save these slips, as you will need them to file your income tax return.

You should also save these slips for six years after they are issued, in case you are audited.

Filing taxes in Canada for the first time

You become a taxable resident of Canada for income tax purposes when you establish significant residential ties in Canada.

Residential ties include:

- A home in Canada

- A spouse or common-law partner and/or dependents who move to Canada with you

- Personal property such as car or furniture

- Social ties in Canada

- a Canadian driver’s license

- Canadian bank accounts and credit cards

- Health insurance with a Canadian province or territory

Usually, you are considered to have established those ties the day you arrive in Canada.

As a resident of Canada you must file a tax return if you owe tax or want to request a tax refund.

Even if you have no income to report or taxes to pay in Canada, you may be eligible for certain tax payments or credits. To receive these credits you must file an income tax return.

For the first year you file taxes in Canada, and for each tax year you are a resident in Canada for tax purposes, you generally use the General Income Tax Benefit Package for the province or territory where you live on December 31st of the tax year. You must use the package for your province or territory as tax rates vary from province to province.

For the part of the year you were not a resident of Canada you only pay income tax on Canadian source income.

For the part of the year that you became a resident of Canada, you must report all the income you earned from sources both inside and outside of Canada on your Canadian income tax return. In some cases, pension income from outside of Canada is exempt from taxes in Canada due to a tax treaty, but you must still report this income on your tax return.

Generally, you cannot deduct moving expenses incurred when moving to Canada from your taxes, except if you are a student.

For a list of tax treaties, and full instructions on filing your first income tax return in Canada, visit the Canada Revenue Agency’s web site.

Contact Information

Canada Revenue Agency: 1-800-959-8281

International Tax Services Office: 1-800-267-5177 (toll free from Canada and the US) or +1-613-952-3741 (outside Canada and the US)

Regular Hours of Service

Monday to Friday

8.15hrs/8:15am to 17.00hrs/5:00pm Eastern Time (ET)

Closed on holidays

Extended Hours of Service

Monday to Thursday, Mid-February to the end of April

8.15hrs/8:15am to 21.00hrs/9:00pm Eastern Time (ET)

Fridays

8.15hrs/8:15am to 17.00hrs/5:00pm Eastern Time (ET)

If you are a resident of Canada, send your income tax return to your local Canada Revenue Agency Tax Centre.

If you are not a resident of Canada, send your income tax return to:

International Tax Services Office

Post Office Box 9769, Station T

Ottawa ON K1G 3Y4

CANADA

By Jess Gerrow, who traded city life in Canada for island life in the Mediterranean two years ago. She is a postgraduate marketing student, blogger, and freelance writer.

- My Life Abroad -

A selection of expat stories

"A fun compulsive read!"

J. Matcham, Amazon

"I strongly advise people ready to live abroad to read this book!"

Patrice, Amazon

Social Insurance Numbers

Social Insurance Numbers Fexco payment solutions

Fexco payment solutions